Over he weekend, Powell was interviewed n 60 Minutes and while he did not say anything new, he reiterate that there will be no early interest rate cut in March, and hinted hat any first move will have to await the middle of the year and be contingent on the Fed having more "confidence" that inflation is heading "sustainably'' towards the 2% target.

One would think that with the 6-month annualized rate of core PCE at 1.85% and 8-month annualized rate at 2.08%, that Powell would have a bit more confidence. Especially when considering the lags with Shelter that have not caught up yet.

We also heard from Fed Governor Bowman late Friday, who cited several risks to inflation moving higher, including geopolitical conditions, easing of financial conditions, and continued labor market tightness. She wants to remain cautious and be patient, as she feels if they cut too soon it could require more rate increases in the future. She has been quite hawkish, especially when you consider that oil prices have come back down to $72/barrel, the Fed is extremely restrictive and becomes more so as inflation comes down and they keep the Fed Funds Rate elevated, and the job market is not what it seems as we have gone over...it's all adjustments.

The Bank of Japan has begun to signal that they may be confident enough to end NIRP (negative interest rate policy) in the near term. JGB yields are moving higher after an FT article today titled "BoJ signals readiness to exit negative rates." This too has pressured yields across the globe higher.

Buying a Home for the Long-Term has Always Been a Good Idea

We have broken down many times why we feel the housing market is on good footing and how supply and demand dynamics this year should lead to around 4.5% to 5% appreciation. But the media continues to try to plant the seeds of doubt and talk about a housing bubble, deterring potential borrowers.

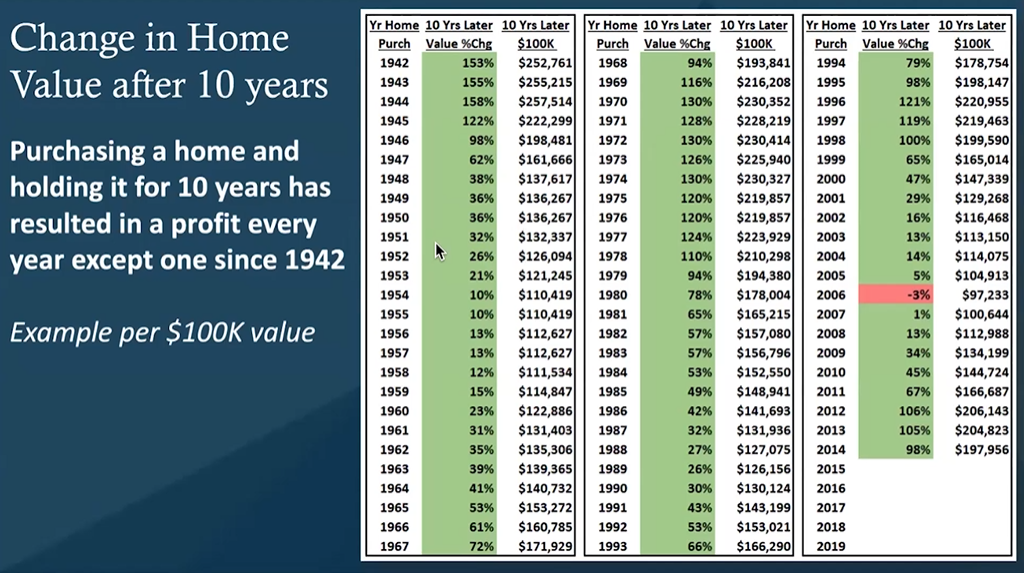

Most people buy and live in their home for at least 10-years. Looking at the chart, you can sec that since 1942, if you bought a home and held it for 10-years, you would have only lost money one year - if you bought in 2006. In every other scenario you would have created a massive amount of wealth - the chart shows how much you would have gained 10-years later for each $100k your home was worth, for ease of numbers.

The bottom line is that the housing situation could not be more opposite than 2006 and housing has almost always proved to be one of the very best investments over the long term.

This Week

Monday: ISM Services, Senior Loan Officer Survey

Wednesday: Mortgage Apps, 10-year Treasury Auction

Thursday: Initial Jobless Claims, 30-year Auction

Credit: Josh Sun