Real Estate News in Brief

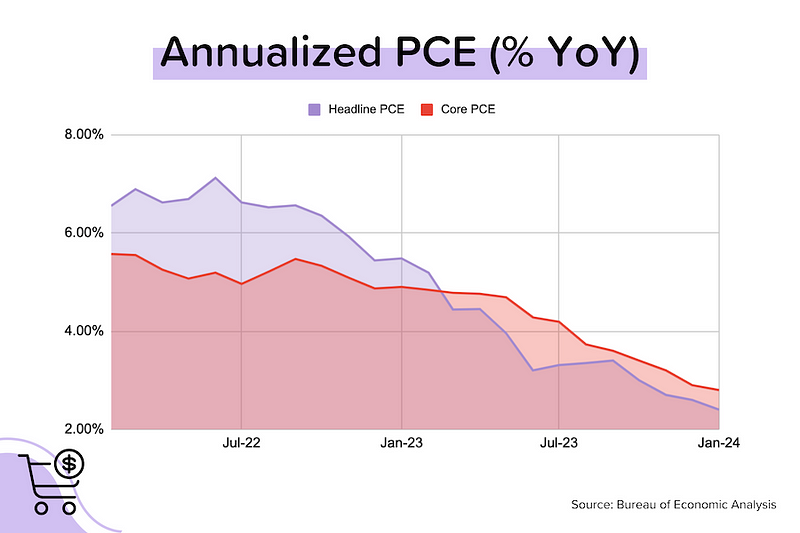

So much is dependent on mortgage rates, and rates will follow inflation lower (eventually). With “core” PCE approaching the Fed’s 2% target, how close is ‘close enough’ for Powell & Friends to start cutting rates?

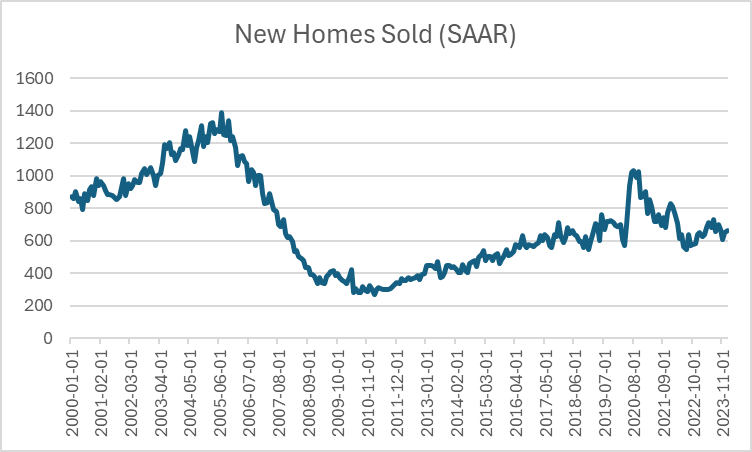

Builders bullish, but sales meh. New home sales for January 2024 were flattish month-over-month at 661,000 units (on a seasonally-adjusted, annualized basis). The median price rose 2% to $420,700, with the average price jumping 8% to $534,000, as increased sales in the higher-priced West region yanked the average up. [Census Bureau] In January, roughly 14% of the total homes sold (new + existing) were new homes. The longer-term average is closer to 10%.

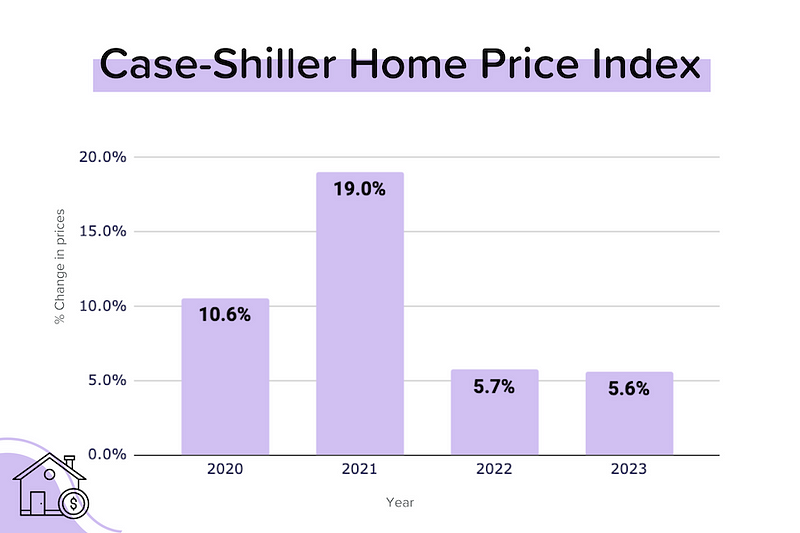

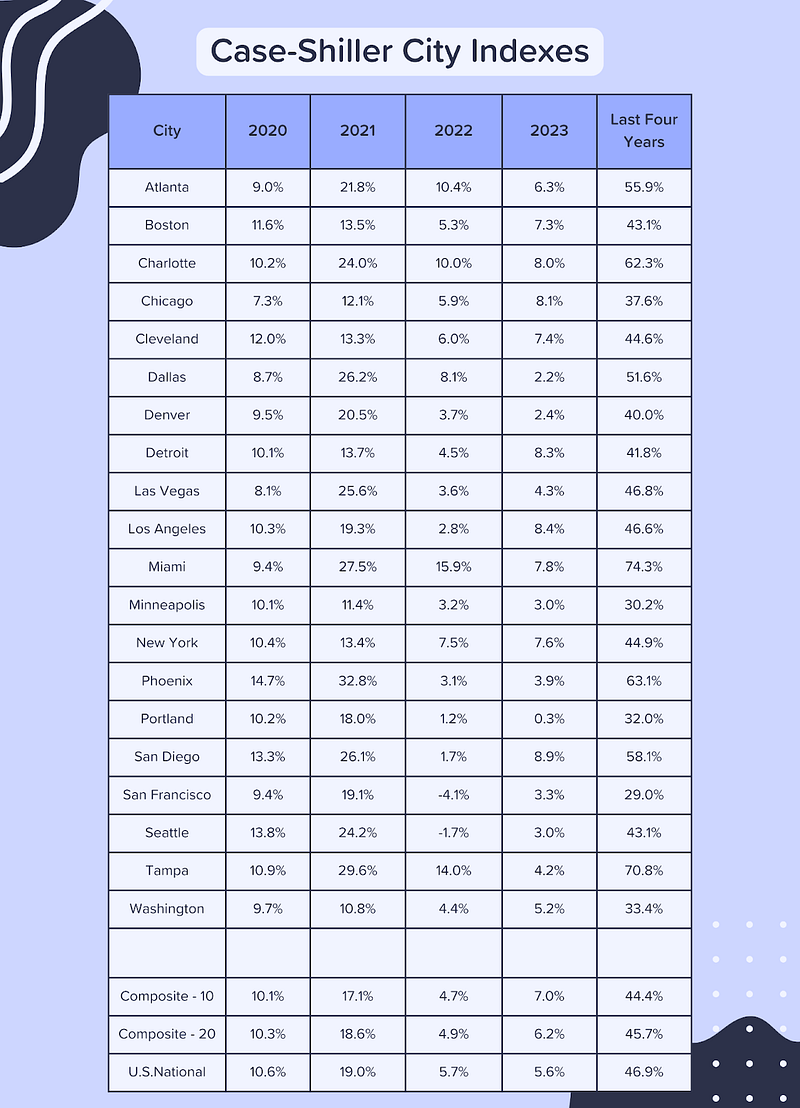

National home prices set another record. The Case-Shiller national home price index for December 2023 rose 0.2% month-over-month on a seasonally adjusted basis, the same as it did in November 2023. For full-year 2023, the index rose 5.6%. Over the last four years, the index is up 47%!

But prices aren’t rising everywhere. Four of the big city indexes (Minneapolis, Portland, San Diego, and San Francisco) showed seasonally-adjusted declines ranging from 0.1% to 0.2% MoM in December 2023. Portland prices have declined for the last three months; San Francisco, the last two.

The FHFA national price index for December 2023 rose just 0.1% month-over-month on a seasonally-adjusted basis. That was the smallest growth since January 2023. For full-year 2023, the national index rose 6.6% year-over-year.

Three of the FHFA’s regional indexes saw MoM declines (on a seasonally-adjusted basis): West North Central (-0.9%), New England (-0.6% MoM), and West South Central (-0.3%). The strongest region was the South Atlantic (+0.7%).

Note:

West North Central = IA, KS, MO, MN, NE, ND, SD

West South Central = AR, LA, OK, TX

South Atlantic = DE, FL, GA, MD, NC, SC, VA, WV

US economy keeps rolling. The second reading of 4th quarter 2023 GDP came in at +3.2% annualized, slightly lower than the 3.3% reported previously, but still far from recession territory.

Note: There are three GDP readings for each quarter (first = ‘preliminary’, second = ‘revised’, third = ‘final’).

Key inflation metric moved lower. The Fed cares about CPI, but it focuses on “core” PCE. In January 2024, “headline” PCE dropped to +2.4% YoY (from +2.6% YoY in December 2023), and “core” PCE eased to +2.8% YoY (from +2.9% YoY). Was this enough of an improvement to encourage the Fed to cut rates in March or May? Probably not. The 0.4% MoM increase in prices in January suggested an acceleration in inflation, which no one wants to see.

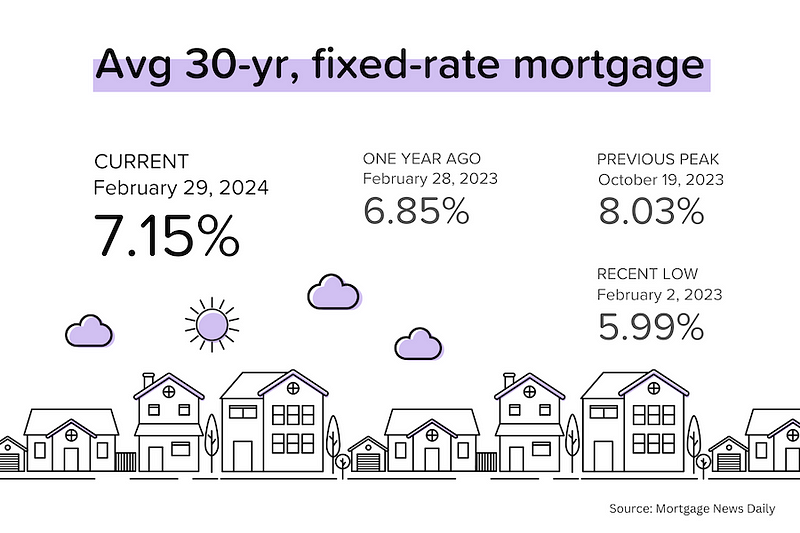

Sales activity is rate-dependent on rates. After a rocking +9% month-over-month growth in December 2023, pending home sales for January 2024 backtracked 5% MoM. Why? Swings in mortgage rates. December 2023 included two weeks near 6.5%. But rates started rising again in January 2024.

A Look Back at Four Crazy Years

Now that we’ve got the Case-Shiller data for December 2023, we can zoom out and remind ourselves just how enormous the home price movements have been since the end of 2019. Keep in mind that the average annual growth in Case-Shiller’s national index over the last 35 years is just under 5%.

As the table below shows, over the last four years:

- Case-Shiller’s National home price index rose 47%.

- The Miami and Tampa indexes both jumped more than 70%!

- The Charlotte and Phoenix indexes both rose more than 60%.

- Even the city with the slowest growth in home prices (San Francisco) still saw prices rise 29%.

- Only two cities saw their price indexes decline in any given year (Seattle and San Francisco, both in 2022).

Two obvious implications. First, that people who bought before or at the beginning of this period are sitting on massive amounts of home equity.

Second, when you layer on what mortgage rates have done (from under 3% in early 2021 to over 8% in late 2023), affordability has gotten crushed.

A Mismatch Between Builder Confidence and Home Sales

If you looked at the share prices of the large, listed new home builders (D.R. Horton, Pulte, Lennar, K.B. Homes, NVR etc.) you’d guess that new homes sales must be skyrocketing. But they aren’t, at least not at the national level.

On a SAAR basis, we sold 661,000 new homes in January 2024. That’s roughly the same pace that new homes were selling pre-pandemic. It’s also half the level we saw during the 2003–2005 overbuild that helped precipitate the 2007–2008 housing crash.

With all the talk of builders benefiting from the limited inventory of existing homes for sale, the reality is more muted. In January 2024, the total homes sold (new + existing) was 4.7 million (SAAR), of which new homes represented 14%. The average level from 2005–2019 was 10%. So new homes are relatively more important currently, but existing homes are still by far the most important.

D.R. Horton’s share price

So what exactly is happening? Why the mismatch between the stock prices of builders and the rather unimpressive trajectory of new home sales? I’ve got a few ideas:

- The stock market is simply anticipating lower rates in the near-term, and an accompanying jump in new home sales. [A reasonable assumption, but lower rates will boost existing home sales too.]

- There is the expectation that builders will shift capital and labor from multifamily to SFH construction over the next few years, increasing new home supply. [Multifamily permits have plummeted in recent months = the wave is breaking.]

- The big listed builders are gaining market share [this is definitely true]. They’re able to buy land and offer financing incentives (like rate buydowns) at a scale that smaller builders can’t match.

Mortgage Market

It was a calm week for bond yields and mortgage rates. The apparent reacceleration in inflation (January PCE +0.4% MoM) could have sparked another sell-off, but it didn’t. That tells me that the market now feels reasonably comfortable with its implied rate cut forecasts: nothing until June.

Current odds of a Fed rate cut:

- March 20: 3% (from 5% last week)

- May 1: 24% (from 27% last week)

- Jun 12: 65% (from 67% last week)

CoreLogic’s most recent Loan Performance Insights noted a small increase in mortgage delinquency rates — from 3.0% in December 2022 to 3.1% in December 2023. Both are near historic levels, so nothing to get worried about. With home equity levels up so much, and unemployment so low, it’s no surprise that homeowners are paying their mortgages on time.

They Said It

“U.S. home prices faced significant headwinds in the fourth quarter of 2023. However, on a seasonally adjusted basis, the S&P Case-Shiller Home Price Indices continued its streak of seven consecutive record highs in 2023. Ten of 20 markets beat prior records, with San Diego registering an 8.9% gain and Las Vegas the fastest rising market in December, after accounting for seasonal impacts.” — Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones

“The job market is solid, and the country’s total wealth reached a record high due to stock market and home price gains. This combination of economic conditions is favorable for home buying. However, consumers are showing extra sensitivity to changes in mortgage rates in the current cycle, and that’s impacting home sales.” — Lawrence Yun, NAR’s Chief Economist

“Early-stage mortgage delinquency rates increased in December 2023 from one year earlier but remained near historic lows…However, other types of consumer credit showed increases in serious delinquency rates at the end of 2023. The Federal Reserve reports that the number of credit-card and automobile-loan transitions moving into serious delinquency were above pre-pandemic levels, which could be a signal of increased financial stress for some Americans.” — Molly Boesel, CoreLogic’s Principal Economist.